What a total opposite for cryptocurrency investors! – The road past the $46,000 resistance seemed to be emerging for Bitcoin (BTC)† Not only were current risks in financial markets well integrated into prices, but nothing predicted a reversal in the situation from last week. However, since mid-March, two catalysts have emerged to thwart the revival of the king of cryptos.

First, the future vice president of the FED, Læl Brainard, surprised her world† Known for her lenient side, she admitted that more aggressive monetary tightening than expected would be needed to fight inflation. And then this unexpected thunderclap was sadly confirmed in FOMC’s closing minutes.

This now leads to an asset balance cut of about $95 billion per month in addition to interest rate hikes. Starting in May, the FED will focus on economic stability at the expense of price support for risky asset classes. Clearly cryptocurrencies have taken the hit, with BTC on the front line, which is dangerously close to another support. Faced with this new monetary paradigm, are we witnessing a return of uncertainty around the prices of the king of cryptos?

This Bitcoin price analysis is brought to you in collaboration with the Coin Trading and Its Algorithmic Trading Solution finally accessible to individuals.

Bitcoin – Sudden Return Below $46,000

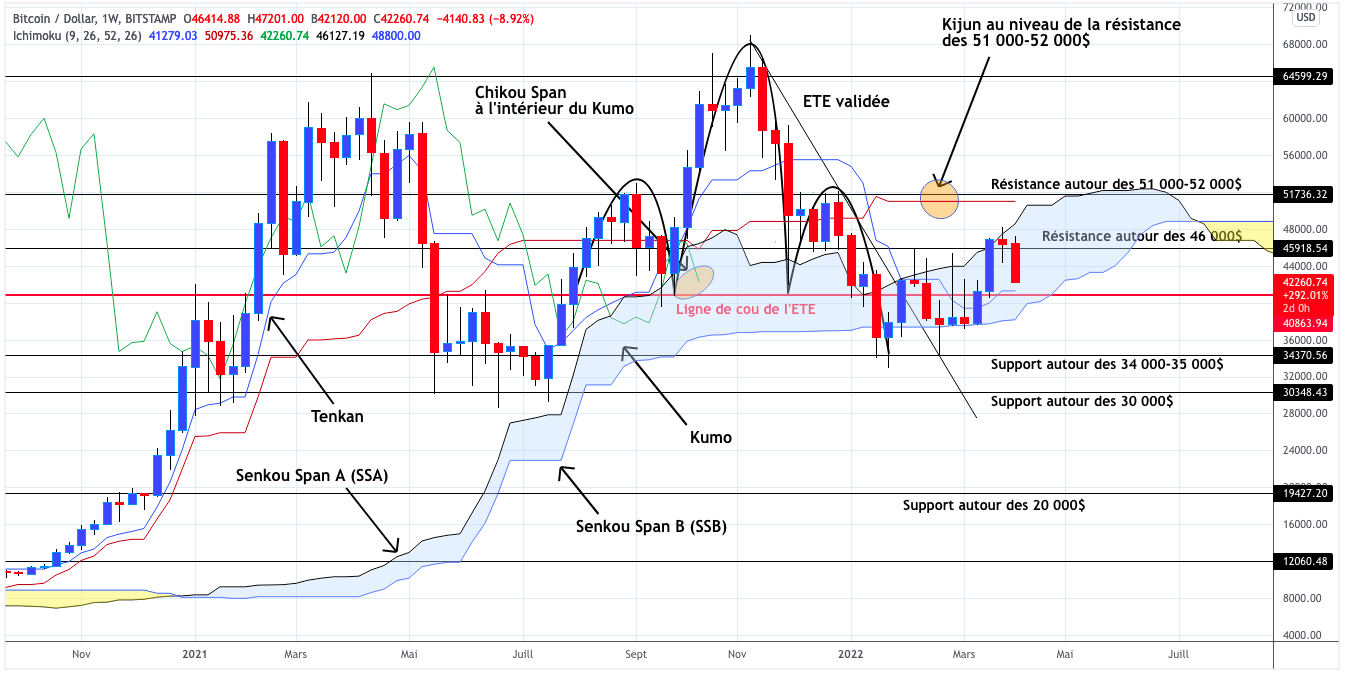

The big weekly bearish candle is not a pretty sight because Bitcoin prices fell from $47,000 to $42,000. Nevertheless, I had voiced my reservations upstream, as the previous one left me skeptical of the dynamics to come. Obviously, this week’s news has confirmed this warning.

For investors/traders, the so-called crossing the $46,000 resistance is the worst adverse technical signal that can happen to them. Especially since it is doubly a failure, if we coordinate it with certain curves of the ichimoku in weekly units. On the one hand, the BTC returns in the center of the Kumo (cloud) and very close to the Tenkan. On the other hand and simultaneously with the latest price movements, the Chikou Span is once again embedded in the cloud.

All of these recent technical signals would be enough to bring the shoulder-to-head-shoulder (ETE) back on the table in the event of a rapprochement near the $41,000 level. But also a return to the neutralization of the bull cycle since 2019, which would be relative given the excellent harvest years of 2020 and 2021.

Bitcoin – Further Consolidation Towards $41,000?

Considering how it hurts, Bitcoin is likely to threaten the $41,000 support, a key level of past ETE validation. It would be better if the red line was not crossed. Otherwise, we would jeopardize the recovery that started in mid-March. Which again spoils hopes of a favorable trend reversal. And in that sense, crossing the downward trendline since the last ATH in November 2021 wouldn’t help much anymore.

Since the nightmare doesn’t end there, Tuesday and Wednesday’s bearish candles triggered a drop in BTC prices below the Tenkan and Kijun respectively. Then at the same time, that of the Chikou Span is below the USD 46,000 resistance. Fortunately, the two pointed out stay above the Kumo. This leaves us hoping that the $41,000 can serve as a foothold for another attempt to move beyond the $46,000.

In summary, many investors believed that crossing the $46,000 resistance would soon be a thing of the past. But that was without taking into account the abrupt reversal of the Fed’s monetary policy, which I believe is putting things in order given inflationary pressures in the United States.

Add to that a strong dollar and a rise in bond yields that don’t encourage risk taking. As a result, its high correlation with stock indices puts Bitcoin at a disadvantage. A chance to remember that technical analysis is not a reliable tool to predict price movements. Hence the importance of confirming it with fundamental analysis.

From now on, we should be alert if Bitcoin has the bad inspiration to drop towards $41,000. In the event of an ETE neckline bounce, the $46,000 resistance would still be in the cards hoping for a better outcome than the previous one. Conversely, the price trend of the king of cryptos would return to uncertainty mode.

Is it possible to get g . to bewin every time? Whether Bitcoin price is in great shape or going through turbulence, Coin Trading offers you to increase your chances of success. Indeed, Coin Trading gives individuals access to a trading instrument algorithmic and 100% automated. A true trend mechanism, this tool is designed to adapt to market reversals and position itself on the most dynamic crypto assets of the moment.