Declines, time and again: the communication of the major banking networks about the returns of the funds in euros of their life insurance sounded like a chorus in recent years. If the trend generally continues, banks now seem reluctant to pay further of these funds valued by savers for their capital guarantee.

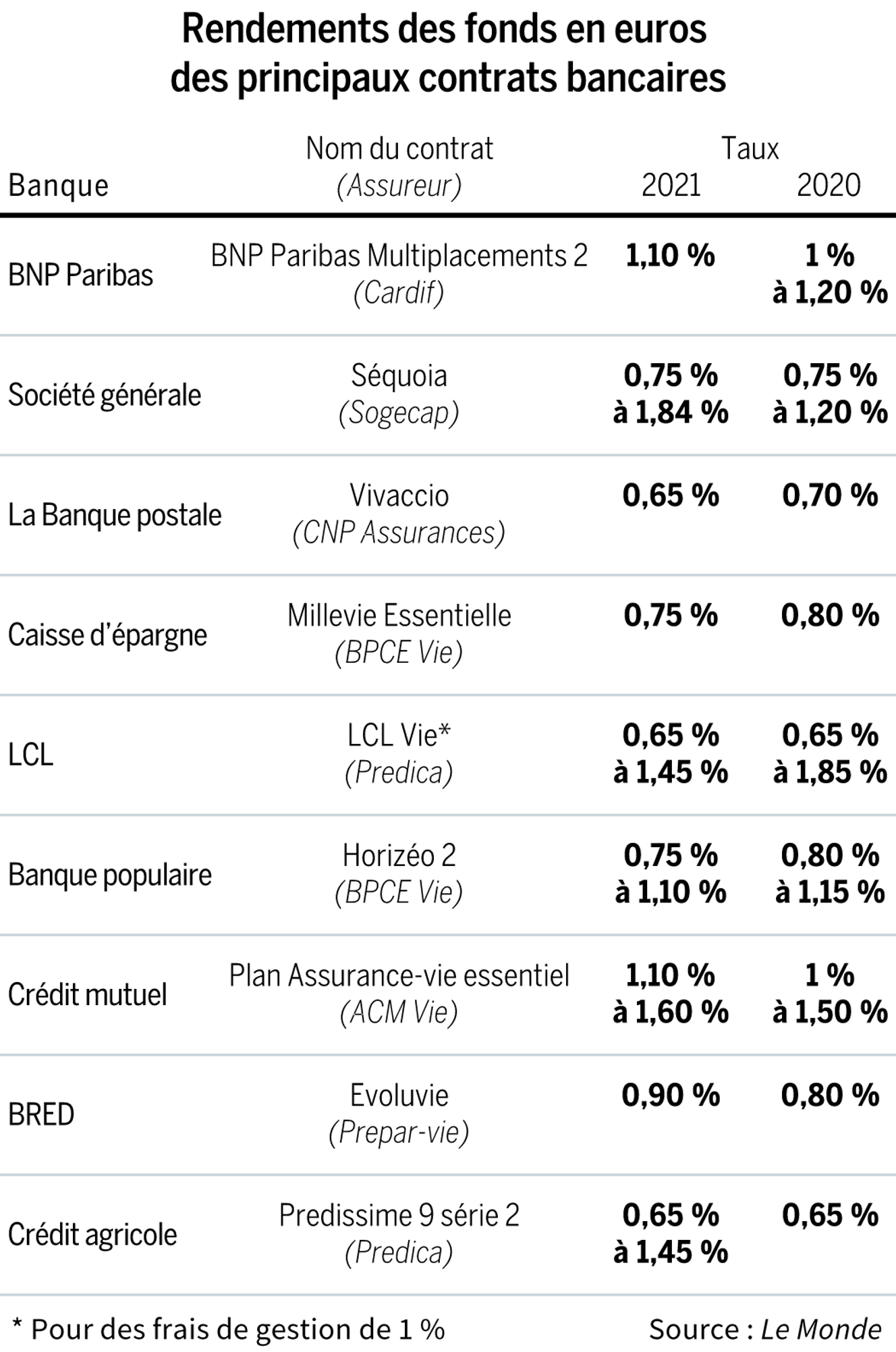

According to France Assureurs, the market served an average of 1.3%. At the bottom of the pack in terms of returns, La Banque Postale certainly made a further decline in 2021. The consumer contract, Vivaccio, fell from 0.70% in 2020 to 0.65% last year. These rates do not include expenses, but will carry 17.2% of Social Security contributions – so the return after deductions will be only 0.54%. And this isn’t the establishment’s worst figure: the Solésio Vie contract reported just 0.50%.

Another player in decline: the Caisse d’Epargne. Its Millevie Essentielle life insurance policy recorded a rate of 0.75% compared to 0.80% in 2020. For the others, on the other hand, the trend is more towards stabilization, or even an increase in the rates paid out thanks to bonuses – increases in the rate for savers who pay meet certain criteria.

Also, some players have stepped up their bonus policy in 2021, such as Société Générale. Until now, this bank offered a higher return on contracts of 76,200 euros. This bonus is now doubled by another, linked to the share of units of account subscribed to in the contract: the basic return can increase by 50% if the share of these risky investment vehicles exceeds 50%. As a result, the red and black bank’s 2021 returns make all the difference. For example, from 0.75% to 1.84% on the Sequoia contract.

Old Abused Products

At Crédit Agricole, too, rates now vary according to policyholders’ risk appetite. Below 25% of units of account, the return on the fund in euros is capped at 0.65%, but rises to 1.05% with 30% to 50% risky support. And reaches 1.45% if the customer owns more than 50% of the units of account. Same observation for LCL products. The LCL Vie contract has a base rate of 0.65% (for management fees of 1%) that can go up to 1.45% for policyholders with 50% or more units of account.

One player has opted for a slightly different strategy: BNP Paribas. If the bank also offers a bonus to its customers who prefer units of account, it wants to communicate about the average return excluding bonuses. It fits, she says, in a logic “convergence of rates served, regardless of products and distribution channels” and specifies that 90% of its contracts have a net rate of 1.10%. As a result, BNP Paribas contracts are among the best non-bonus rates in the banking world.

You still have 21.41% of this article to read. The following is for subscribers only.