Now that inflation is hitting houses French full force, the State is constantly looking for a solution to alleviate them. The various child benefits have also been created to go in this direction. And the tax cuts are also a plus that cannot be overlooked. This is especially true for the housing tax, which is currently being reformed. Will you benefit from the following changes planned by the State? In this article we tell you more about it!

Housing tax: changes that have benefited the French

In 2018, the State already noted a decrease in benefits in residence taxes. A fairly heavy attack that prompted the French to take rather drastic measures. And the resulting decision was simply ideal for French people with a primary residence there. It is therefore no surprise that the State has allowed a cancellation of the latter for the year 2021 for some houses†

These were already almost 80% of the households that are exempt from this municipal tax. If the others could not escape, the State proposed other alternatives. This concerned a payment with a reduction of about 30%† And it could still improve for the year we just started.

A new discount in sight!

The housing tax rate will therefore be reduced again before 2022. A difference what will be this time 65% to relieve French households in their expenses. It should be noted that the calculation of this load is made according to several criteria. This is especially the case depending on the department you are in. The various construction details of your home must also be taken into account payment method.

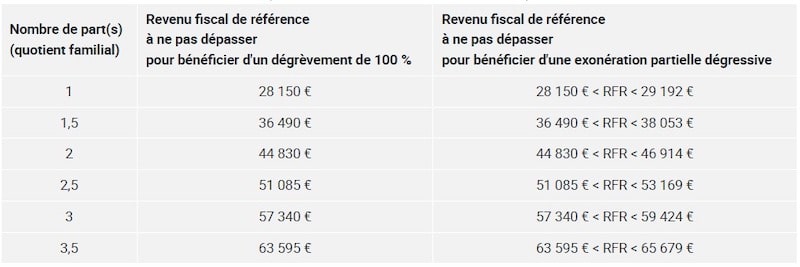

Income ceiling to take advantage of the exemption. Screenshot

The municipal tax is determined at the beginning of the year† From there, the state also determines the profiles that are then taxable. Likewise, the responsible authorities will be able to determine whether new discounts can be offered to French households. A situation that can only do good in this period of inflation.

Who will be able to enjoy the new benefits of the residence tax?

For this year, the reduction is estimated to be between 100 and 65%. But not everyone benefits! In fact it takes meet different criteria to avoid this tax. All then depends on the reference tax income that you have done in the past year. If this last does not exceed 28,150 euros, the exemption is 100%. However, if the RFR is between 28,150 euros and 29,192 euros, it is possible to apply for a partial and degressive exemption.

In the case of an RFR of 44,830 euros for two people, the amount of 100% exemption is granted by the state. If the latter is estimated between EUR 44,380 and EUR 46,914, the household can only benefit from a partial exemption. As you can see, everything depends on your income!