(Photo credits: Adobe Stock – )

(Updated with futures contract, Saxo Bank commentary, China markets close, European bond market open)

- No clear trend in sight for major European indices

- Wall Street gained between 1% and 1.9% on Thursday

- US 10-year yields continue to rise

by Laetitia Volga

PARIS, March 25 (Reuters) – Major European stock exchanges are expected to show little change as they open on Friday, as caution remains warranted regarding the situation in Ukraine at the start of the weekend.

Futures contracts point to a 0.11% rise for the Paris CAC 40 .FCHI in the early exchanges, -0.04% for the Frankfurt Dax .GDAXI and a -0.2% decline for the FTSE on London .FTSE .

European equities ended loosely but with narrow spreads on Thursday as the war in Ukraine entered its second month and Western countries pledged in Brussels to step up aid to Ukraine and impose new sanctions on Russia.

Also read: West united behind Kiev, rejects Moscow’s demand for the ruble

“The market is undecided and it will remain so. The market lacks an upward catalyst (…) Latest economic indicators (notably the business environment published by INSEE) confirm that growth in Europe is slowing down. The United States is not spared. The delay at work has not yet been fully priced in. Therefore, in the short term it is advisable to be very careful and choose stocks that can withstand adversity,” Saxo Bank wrote in a note.

Stock market: tracking values in Paris and Europe

AT WALL STREET

The New York Stock Exchange ended higher on Thursday, benefiting from chipmaker gains and fast-growing stocks to bounce back on the sidelines of the decline in oil prices.

The Dow Jones Index .DJI gained 1.02% to 34,707.94 points, the S&P-500 .SPX gained 1.43% to 4,520.16 points, and the Nasdaq Composite .IXIC rose 1.93% to 14,191.84 points.

Futures point to a flat session to close out the week.

IN ASIA

On the Tokyo Stock Exchange, the Nikkei .N225 gained 0.14%, followed by the ninth consecutive session in the green, the longest string of gains since September 2019. Over the course of the week, the index gained 4.9%.

Chinese stock markets have been weighed down by concerns about the listing of Chinese companies on Wall Street.

The U.S. authority responsible for overseeing the books of publicly traded companies said Thursday it was unsure whether Beijing should provide it with auditing documents required by a new U.S. law on foreign companies.

The CSI 300 index .CSI300 of large caps in China fell -1.8% and the Hang Seng .HSI in Hong Kong fell -2.53%.

RATE

In the bond market, ten-year US Treasury yields US10YT=RR rose 2.5 basis points to 2.3648%.

In early trading, the 10-year German Bund yield DE10YT=RR is stable at 0.527% after a three-year high on Thursday at 0.555%.

CHANGES

The dollar lost -0.22% against a basket of international currencies .DXY and the euro rose to $1.1026 EUR=.

Against the dollar, the yen rose -0.49% after a low since December 2015 during early trading. JPY=

Despite the day’s recovery, the Japanese currency is currently losing more than 2% for the week as a whole, penalized by the surge in energy prices, which is pushing up import costs, and by the growing divergence between Japan’s monetary policy and that of Japan. of the United States, where the Federal Reserve appears to be heading for an increasingly restrictive trend.

Bank of Japan Governor Haruhiko Kuroda reiterated Friday that a weak yen is good for the economy, brushing aside fears that the currency’s depreciation will do more harm than good to this poor and import-dependent country.

OIL

Variations in the oil market have been limited in the absence of a European announcement on an embargo on Russian hydrocarbons due to certain countries’ reliance on fossil fuels from Russia.

Brent LCOc1 fell -0.3% to $118.67 a barrel and US light crude (West Texas Intermediate, WTI) CLc1 -0.36% to $111.93.

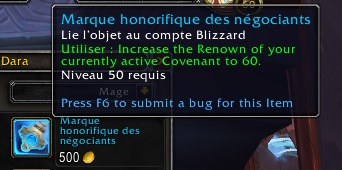

PRINCIPAUX INDICATEURS ÉCONOMIQUES À L'AGENDA DU 25 MARS

PAYS GMT INDICATEUR PÉRIODE CONSENSUS PRÉCÉDENT

DE 09h00 Indice Ifo du climat des mars 94,2 98,9

affaires

EZ 09h00 Masse monétaire M3 février +6,3% +6,4%

- crédit aux entreprises +4,6% +4,4%

- crédit aux ménages n.d. +4,3%

US 14h00 Indice de confiance du mars 59,7 59,7

Michigan définitif

(édité par Myriam Rivet)

((Rédaction de Paris; +33 1 49 49 50 00;))

((Les valeurs à suivre à la Bourse de Paris et en Europe WATCH/LFR ))