(Updated with futures, Tokyo close, European bond market open, analyst commentary on RBA)

-

European indices expected around equilibrium

-

Wall Street ended in the green, small rise in Tokyo

-

Aussie dollar soars, RBA opens door to monetary tightening

by Laetitia Volga

PARIS, April 5 (Reuters) – Major European stock markets are expected to remain unchanged at Tuesday’s opening, as investors appear to be looking to take a pause pending more information on what the Western powers might decide against Russia.

Futures contracts indicate a 0.01% increase for the Paris CAC 40 .FCHI , a 0.25% decrease for the Frankfurt Dax .GDAXI and 0.15% for the London FTSE .FTSE .

The broad European Stoxx 600 index gained 0.84% and the CAC 40 0.70% on Monday, as the rise in technology stocks took precedence over uncertainties related to the war in Ukraine.

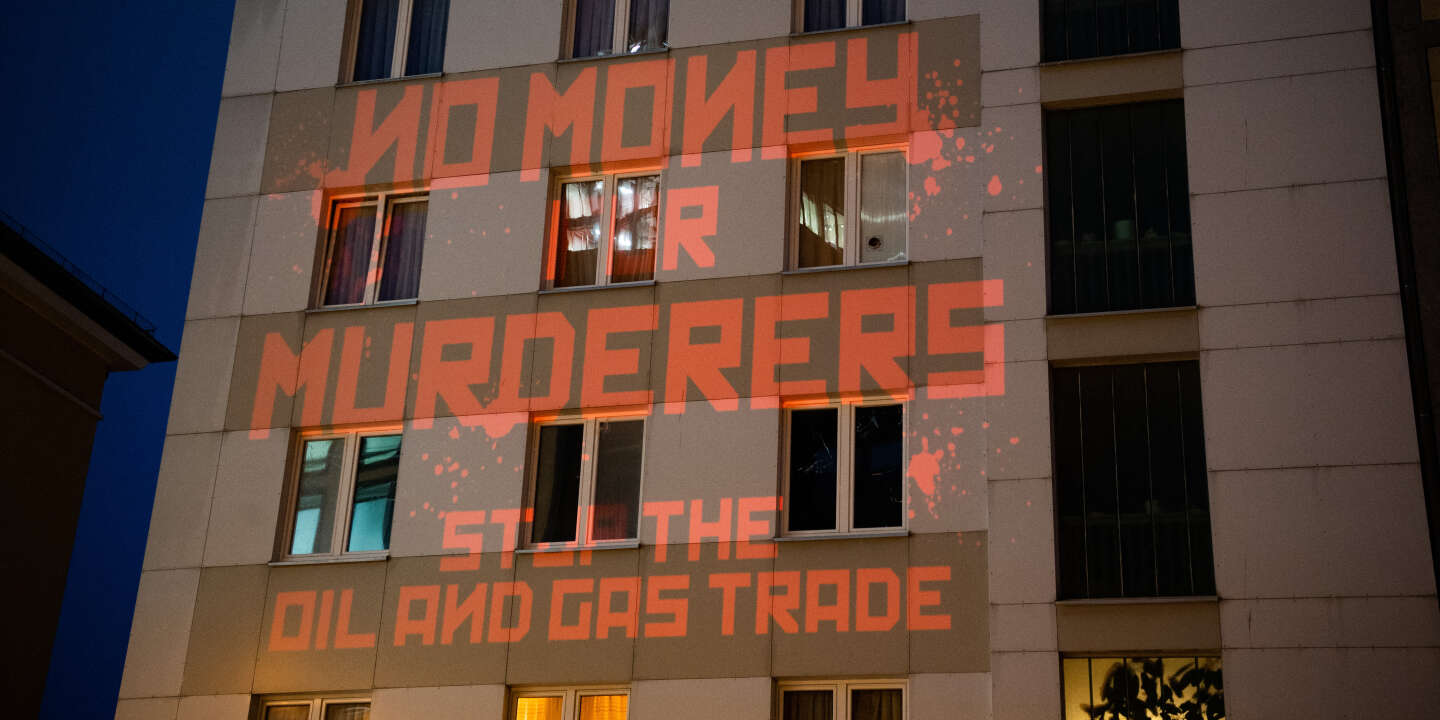

Western countries, citing war crimes committed by Russian forces in Ukraine, are preparing for further sanctions against Moscow, which could lead to a further rise in commodity prices and, consequently, greater pressure on central banks to tackle inflation.

Unsurprisingly, Australia’s central bank kept its key rate at 0.1% on Tuesday, but opened the door for its first rate hike in more than a decade, noting that future inflation data and labor costs will shape its decision-making.

Market participants look forward to the morning release of final March figures for services and composite PMI activity indicators.

Stock market: tracking values in Paris and Europe

AT WALL STREET

The New York Stock Exchange ended higher Monday, driven by large caps and the wave of Twitter action TWRT.N (+27%) in the wake of announcing a 9.2% stake in businessman Elon Musk, now the largest shareholder in the social network. .NFR

The Dow Jones Index .DJI gained 0.3% to 34,921.88 points, the S&P-500 .SPX gained 0.81% to 4,582.64 points and the Nasdaq Composite .IXIC rose 1.90% to 14,532.55 points.

IN ASIA

The Nikkei on the Tokyo Stock Exchange .N225 gained 0.19% at the end of a hesitant session, torn between on the one hand investor caution about companies’ forecasts of the COVID-19 pandemic and the war in Ukraine and, on the other, on the other hand Monday’s positive session on Wall Street.

Chinese markets are closed for a holiday.

RATE

On the treasury side, US Treasury yields fluctuate little, but the two-to-ten-year yield curve segment remains inverted, which is considered a reliable indicator of future recession risks and doubts. †

The yield of ten-year US10YT=RR Treasuries stands at 2.432% and that of two-year US2YT=RR at 2.4549%, reducing the yield differential between these two maturities to -2.47 basis points after approaching – 10 the day before.

The 10-year German DE10YT=RR has changed little in early trading, at 0.534%.

CHANGES

The euro was flat at $1.0965, close to a week-long low and 1.0959 the day before, impacted by the prospect of additional European sanctions against Russia.

The dollar index .DXY, which measures the dollar’s movements against major currencies, is stable.

The Australian dollar (+0.9%) hit a ten-month high against the US dollar AUD= , as the Reserve Bank of Australia (RBA) pulled back from its promise to be “patient” with tightening its monetary policy.

“We can probably expect a rate hike shortly after the (legal) election in May… The RBA’s delay shows the folly of its stubbornness to be too ‘friendly’ at the start of the year (…) It will We will likely have to act faster and harder to raise interest rates from a sadly low and inadequate 0.1%, increasing the risk of a shock to the economy,” said Michael Hewson of CMC Markets.

OIL

Oil prices are soaring as the possibility of new sanctions against Moscow heightens concerns over supply disruptions as nuclear talks with Iran stall.

Brent LCOc1 gained 1.82% to $109.49 a barrel and US Light Crude (West Texas Intermediate, WTI) CLc1 gained 1.8% to $105.14

PRINCIPAUX INDICATEURS ÉCONOMIQUES À L'AGENDA DU 5 AVRIL

PAYS GMT INDICATEUR PÉRIODE CONSENSUS PRÉCÉDENT

FR 06h45 Production industrielle février +0,2% +1,6%

FR 07h50 Indice PMI S&P Global des mars 57,4 57,4*

services définitif

DE 07h55 Indice PMI S&P Global des mars 55,0 55,0*

services définitif

EZ 08h00 Indice PMI S&P Global des mars 54,8 54,8*

services définitif

GB 08H30 Indice PMI S&P Global des mars 61,0 61,0*

services définitif

US 14h00 Indice ISM des services mars 58,4 56,5

* première estimation

(édité par Bertrand Boucey)

((Rédaction de Paris; +33 1 49 49 50 00;))

((Les valeurs à suivre à la Bourse de Paris et en Europe WATCH/LFR ))